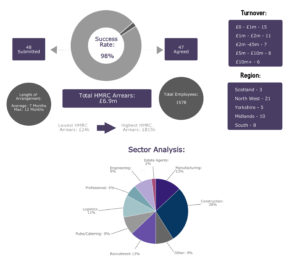

Our team are specialists in this field. We have secured hundreds of Time to Pay deals on behalf of SMEs with tax arrears. As proof of our success, 98% of the Time to Pay proposals submitted in 2019 were accepted by HMRC. This resulted in the repayment of over £6.9 million in tax liabilities, over an average seven-month period and the safeguarding of nearly 1600 jobs.

Businesses experiencing temporary cashflow problems can find it difficult to keep up with tax, VAT and PAYE bills. HMRC takes Crown debt very seriously and uncovers late payers quickly, so it is important to act fast if you or your client are worried about falling behind.

If a payment demand is ignored, additional interest and penalties may accrue. A company in arrears may face distraint or enforcement action where assets can be taken and auctioned to pay debts and costs. HMRC also has the power to start bankruptcy action or winding up proceedings.

Breathing space

For clients experiencing tax debt difficulties, the negotiation of Time-to-Pay arrangements with HMRC sees us work with clients and their advisors to interrogate the numbers and prepare a short-term cashflow forecast. We work out the level of affordable repayments without putting the business under undue pressure.

The process allows business owners and their stakeholders to take a step back and review the business position, which is a hugely valuable exercise. We speak to HMRC to hold off any immediate action, whilst working to devise a thorough and achievable repayment proposal.

This proposal will contain all the key evidence, forecasts and analytical information needed to reassure HMRC about the viability of the business. Importantly, it will demonstrate the ability to settle arrears within the allocated time period, whilst also meeting current tax liabilities.

The results of working collaboratively are of benefit to all parties. And by reviewing each case with a full suite of possible financial solutions, we find that many businesses go on to operate more profitably in future.

At Corporate Strategies – the corporate turnaround and debt advisory division of Leonard Curtis Business Solutions Group – we deal with HMRC departments on a daily basis.

To find out more about how we can support you or your client when under pressure from HMRC or other significant creditors, please contact Ric Miller at rmiller@corporatestrategiesplc.com or call 0800 002 9969.